Rob Kaufold recently turned me on to Ashvin Chhabra’s The Aspirational Investor. In part because of my recent exposure to Tony Deden, I have been starting to think about dynamic preservation as really requiring a very simple thought process or mental model: there are two types of investments in dynamic preservation. Just two. Investments designed to protect asset value, and investments designed to grow asset value. Protect and grow. That’s it. Rather than thinking about a portfolio by asset class, geography, industry, or any other breakdown one can use, maybe it’s as simple as breaking a portfolio into these two classes: protect and grow.

recently turned me on to Ashvin Chhabra’s The Aspirational Investor. In part because of my recent exposure to Tony Deden, I have been starting to think about dynamic preservation as really requiring a very simple thought process or mental model: there are two types of investments in dynamic preservation. Just two. Investments designed to protect asset value, and investments designed to grow asset value. Protect and grow. That’s it. Rather than thinking about a portfolio by asset class, geography, industry, or any other breakdown one can use, maybe it’s as simple as breaking a portfolio into these two classes: protect and grow.

As I think about it, most of us are very good at “grow.” The entire investment industry is really focused on “grow.” Even assets that advisors put their clients in to “protect” are, in many ways, still really designed to grow–or, at least, one could say that they don’t meet Deden’s definition of what a 100-year protective asset might look like.

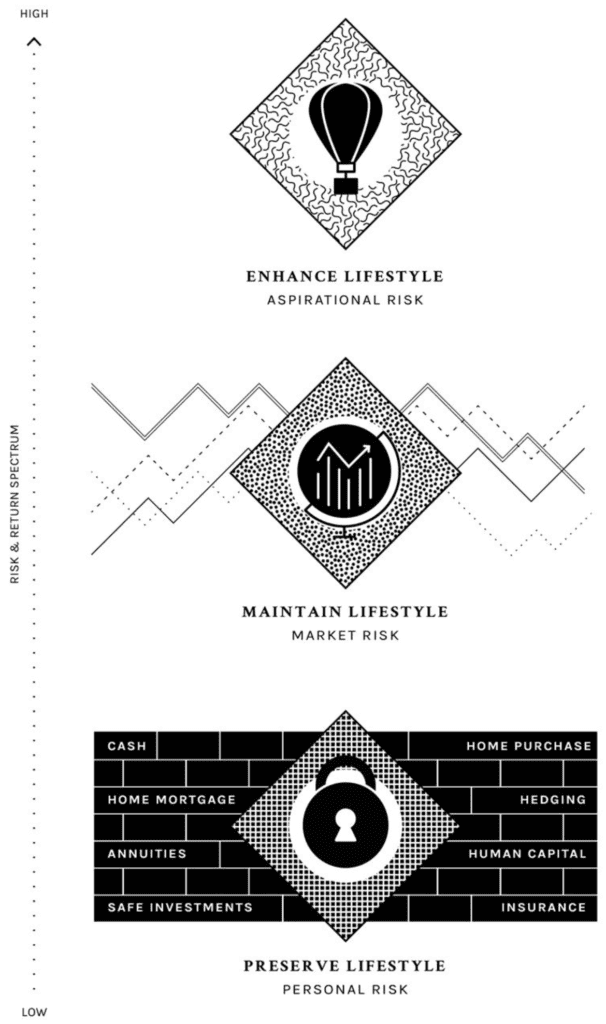

Chhabra’s three buckets

Now, one might not want assets that “protect” to the degree that Deden does, but at least one should have a really carefully thought-out “protect” strategy that will actually protect and not just nominally protect. Again, many have a pretty thought-out grow strategy. But their protect strategy? Not so thoughtful. I’ve been asking around about where investors or advisors have their clients’ “protect” assets. And lots of the answers aren’t very protective.

Anyway, more on that some other time when I’ve thought it through more. For now, Rob pointed me towards Chhabra, who is one of the founders of the goals-based investing movement. Turns out that Chhabra’s work fits really well with thinking about dynamic preservation as having these two basic goals: protect and grow. He talks about the “desire for safety” and the “aspiration to achieve certain goals.” These line up very well with my two buckets. I’m not sure (yet) whether Chhabra has a long enough time horizon for those interested in very long-term dynamic preservation, but the goal-based idea of his work seems right. And Chhabra breaks things into three buckets, not two. And that might be right. His third bucket is “maintain,” which basically means take market risk and achieve reasonable risk-adjusted returns. In other words, keep up with the market. So maybe rather than just protect and grow, it should be protect, maintain, and grow. (Although I think for the UNW segment, most likely his “maintain lifestyle” and “preserve lifestyle” buckets converge? Market risk is absorbable in the UNW segment in a way that it’s not elsewhere.)

Anyway, you can read his book. Or download his 2005 Beyond Markowitz article. Or watch this video. Or all of the above.